On Tuesday night Treasurer Jim Chalmers hailed the Albanese government’s first budget as a “solid and sensible budget suited to the conditions” that would avoid placing additional pressure on inflation.

While it didn’t target the commercial property directly, the sector stands to gain in several key areas.

Fueling ongoing demand for ‘recession-proof assets’

Against a dismal global backdrop, Dr Chalmers announced the government had revised down its economic growth forecast for the 2023-24 financial year to 1.5%, with inflation expected to peak at 7.75% by year end before going down to 3.5% in 2023-2024.

“Slower economic growth will impact businesses and, as a direct consequence, the spaces businesses occupy,” PropTrack economist Anne Flaherty said.

While commercial real estate investors had diversified away from higher-risk assets to ‘pandemic-proof properties’ during the pandemic, they were now adjusting their strategies towards ‘recession-proof’ assets, she said.

This is likely to lead to a “divergence in performance across the various commercial real estate sectors”, Ms Flaherty said.

“Assets housing essential services, particularly those supported by government spending such as childcare and healthcare will continue to outperform, while those with less resilient tenants could see values take a hit.”

Attracting overseas investors to Australia

But while 1.5% growth next year is pretty weak, it’s still enough to attract investment from overseas, Property Council of Australia Chief Executive Ken Morrison said.

“Compared to North America and Europe, it’s still a positive figure. I would expect Australia’s relative position in the world will still make it an attractive place for investment.”

He said economic growth combined with strong employment and healthy net overseas migration — forecast to increase to 235,000 this financial year and next year — will positively impact commercial, retail and also industrial real estate, with the latter benefiting from accelerated adoption of e-commerce during the pandemic.

“[Employment] will underpin performance in office because businesses will need to factor in headcount growth in their new leases, and net overseas migration will have knock-on effects into retail.”

“If the consumer market is expected to stay strong, which is what we’re seeing in the near term, then that’s good signs for the industrial and retail sectors,” he added.

Boosting manufacturing through Future Made in Australia

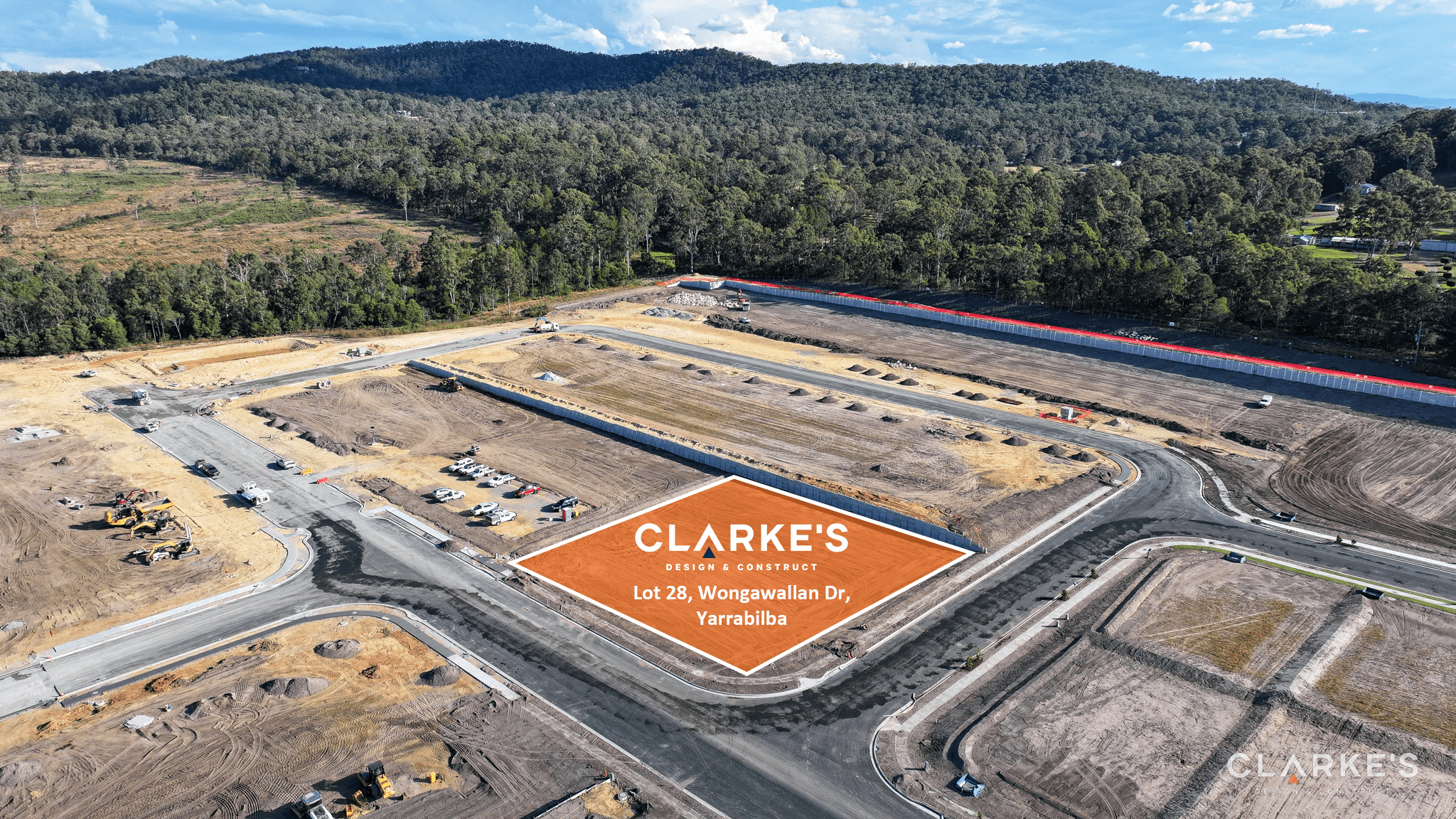

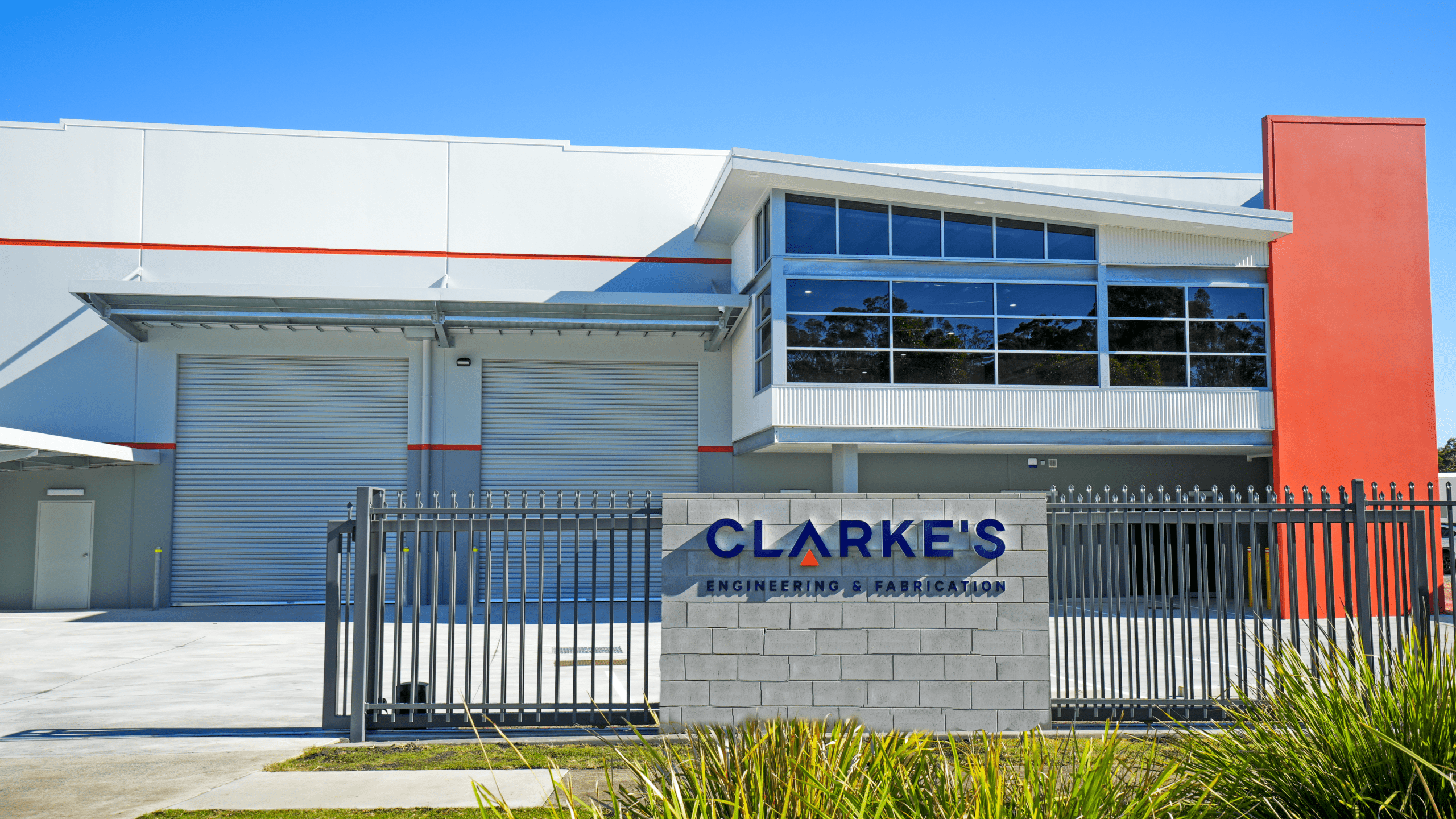

As businesses struggle with supply chain issues, labour shortages and surging energy prices, the Future Made in Australia plan aims to increase and onshore manufacturing, as well as secure and improve supply chains, and expand the industrial base.

This could “further increase the need for industrial and logistics space”, Ms Flaherty said.

The Future Made in Australia plan should help improve supply chains. Picture: realcommercial.com.au/for-sale

“Industrial real estate has been an outperformer over recent years, benefiting from the accelerated adoption of e-commerce due to the pandemic.

“Growth in occupier demand has outpaced the supply of new industrial real estate, pushing vacancy to record lows and rents to new highs.”

Feeding the frenzy for childcare assets

The childcare sector is one of the major beneficiaries of the budget, with the government to invest $4.7 billion in the sector over the next four years in the form of extended parental leave eligibility and duration, and increased subsidies and access to childcare for over one million families.

This will have a direct impact on the childcare real estate sector, Ms Flaherty said, by driving up the number of children in childcare, but also increasing the average number of hours each child spends in care.

“Expanding childcare subsidies should support the success of childcare operators and drive demand for the buildings they occupy.”

An increase in subsidies which make childcare more affordable for more families will lead to more parents demanding early learning places for their children experts say. Picture: realcommercial.com.au/for-sale

Natalie Couper, childcare specialist at Burgess Rawson, said the increased funding heightens confidence in the sector.

“Making more education spaces more affordable just pushes up further demand on these centres.”

Extra childcare subsidies will also increase labour force participation. Dr Chalmers estimated they will allow women with young children to work an extra 1.4 million hours a week in the first year alone — the equivalent of 37,000 extra full-time workers.

“That’s really, really huge,” Ms Couper said.

“Increased workforce participation combined with net overseas migration will help to alleviate very tight labour markets across the country.”

Driving demand for healthcare spaces

The budget promises increased spending on hospitals, the NDIS and also aged care, which will boost demand for healthcare spaces, Ms Flaherty said.

“Other healthcare assets, including clinics and research facilities such as laboratories, will also benefit from increased spending in the sector,” she added.

The government’s healthcare expenditure is expected to continue to rise over coming years due to Australia’s aging population. Currently, 17% of Australians are aged 65 or over, a proportion predicted to hit 20% over the next 10 years, according to the Australian Bureau of Statistics.

Healthcare properties are expected to benefit from the increased spending on aged care and the NDIS. Picture: Getty

Healthcare properties are expected to benefit from the increased spending on aged care and the NDIS. Picture: Getty

Sandro Peluso, director of healthcare and social infrastructure for CBRE, said the budget would have “an extremely positive impact” on the healthcare and social infrastructure sector.

“From an investment point of view, the asset class has never been in a stronger position with regard to government backing.”

He said there was already increased demand from rehab, mental health and allied health hospitals, which was fueling a continued trend towards “super clinics”.

This is being supported by “increased acquisition appetite from institutional investors and private syndicates”, with multiple new entrants to the market, he added.

Easier planning laws to increase commercial property supply

A national Housing Accord will see state governments rezone land and incentivise institutional investors and superannuation funds to invest, with the goal to build one million new homes over five years from 2024.

Rich Harvey, buyers advocate and CEO at propertybuyer.com.au, said he expected planning reform to encourage developers in both the residential and commercial space.

“The reason we have such chronic shortages is simply the planning constraints and the speed at which decisions are made at the council level and state level,” he said.

“If the rules are easier for developers, then you’ll start to see more investment in commercial properties such as office blocks and retail strips.”

Property Council of Australia Chief Executive Ken Morrison said measures that make planning easier for developers will create more opportunities for commercial property development. Picture: Getty

Property Council of Australia Chief Executive Ken Morrison said measures that make planning easier for developers will create more opportunities for commercial property development. Picture: Getty

Mr Morrison said he expected easier planning rules to also increase land supply for industrial property.

“We’ve seen an enormous growth in industrial property in recent years and supply pipelines haven’t kept up.

“Planning blockages equally impact commercial developments as well as housing developments, so it is pleasing to see those commitments there.”

Healthcare properties are expected to benefit from the increased spending on aged care and the NDIS. Picture: Getty

Healthcare properties are expected to benefit from the increased spending on aged care and the NDIS. Picture: Getty Property Council of Australia Chief Executive Ken Morrison said measures that make planning easier for developers will create more opportunities for commercial property development. Picture: Getty

Property Council of Australia Chief Executive Ken Morrison said measures that make planning easier for developers will create more opportunities for commercial property development. Picture: Getty