Residential property has attracted plenty of limelight throughout 2023, and I suspect it will continue to generate headlines in 2024.

Commercial property has had a challenging year, however, we have seen compelling opportunities come to market as buyers and sellers adjust their expectations and financial models.

While rising interest rates have driven a mixed performance across the various commercial property markets, there are some sectors still performing well and 2024 is shaping up as a great year to lock away fantastic assets at attractive prices.

Given the breadth and diversity of the commercial market, it makes sense to break it down by sector to understand what each sub-market is likely to dish up through 2024.

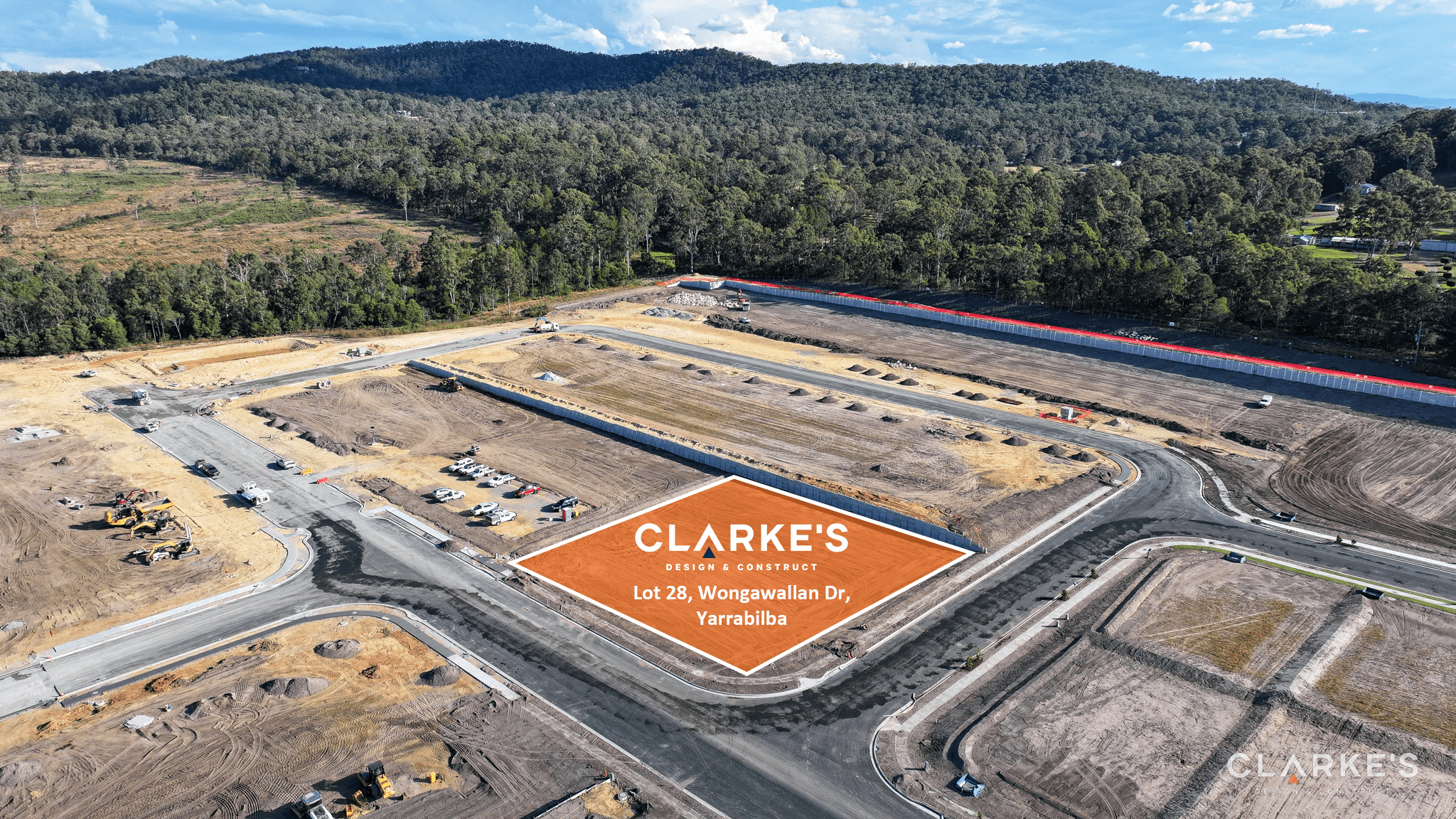

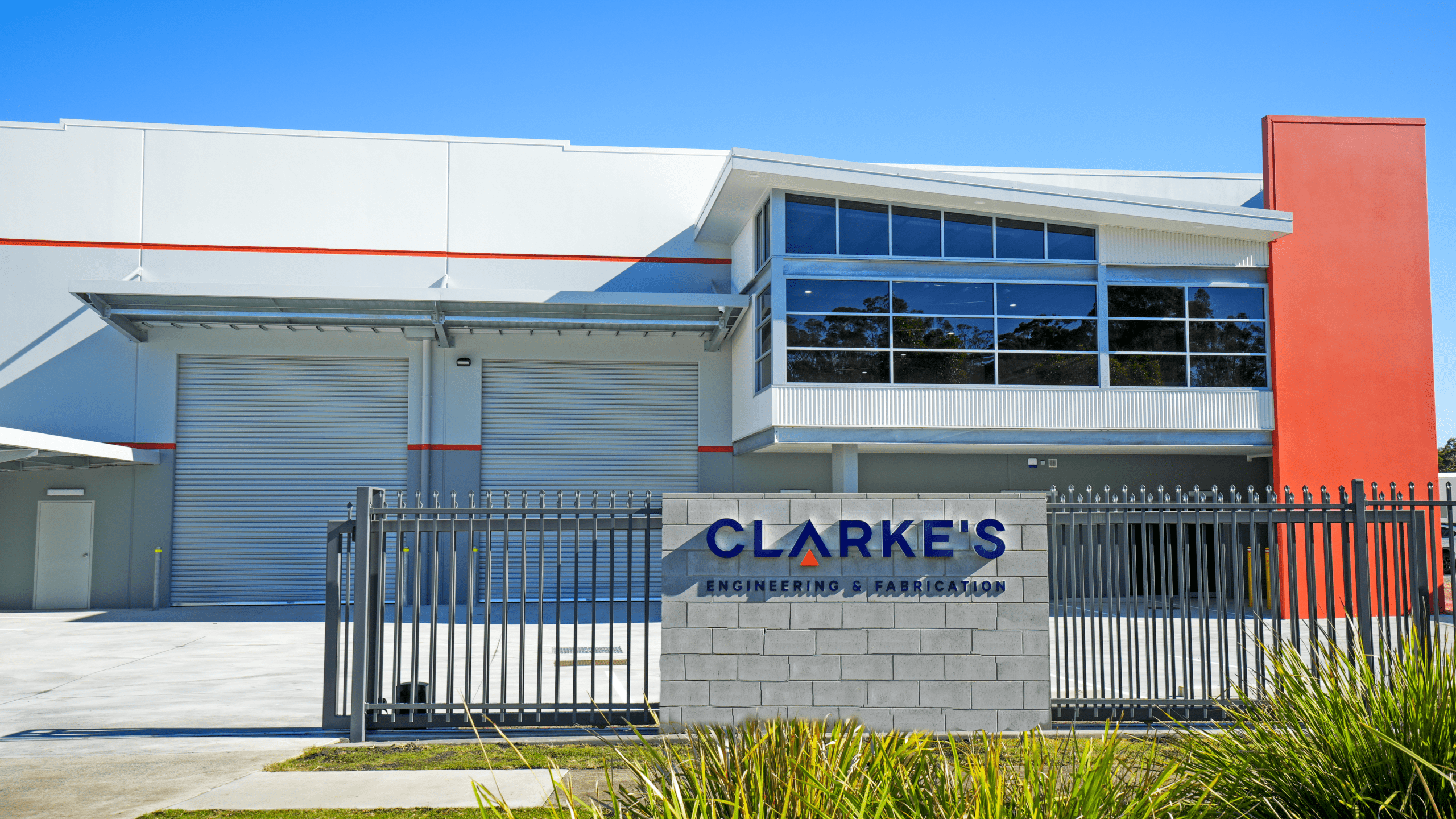

Industrial – a positive outlook for prime locations

Industrial property has been the darling of investors in recent years.

This trend was only accelerated by pandemic-fuelled lockdowns, which sped up the shift towards online shopping, and in turn drove increased demand for logistics facilities.

Factor in record low supply levels and pipeline-limiting construction costs, and you’ve got the perfect trifecta of conditions to underpin rental growth.

While I don’t see industrial rents skyrocketing to the same extent in 2024, I’m confident that properties in prime locations will continue to do well for investors.

In many cases, occupancy costs for industrial tenants remain below 10 per cent of turnover, meaning there is still capacity for rental growth, with available stock expected to remain tight for the foreseeable future.

These factors combined will see investor appetite continue for these assets, with the industrial sector maintaining its reputation as a resilient asset class in the current market.

Retail – neighbourhood centres and fast-food retail stand out

The past four years have seen shifts in consumer behaviour, with the acceleration of online shopping and the cost-of-living crunch driving widespread changes to our spending habits.

This has had a mixed impact across the retail sector, with some assets performing better than others. Assets focused on discretionary goods, such as CBD retail and larger shopping centres, have been most susceptible to volatilities in consumer spending.

On the other hand, those focused on essential services and convenience-based experiences, such as supermarket-anchored neighbourhood retail centres, have continued to attract high demand from consumers despite economic fluctuations.

I expect this trend to continue into 2024 as economic conditions continue to favour retail assets focused on essential goods and services.

Fast food properties are another standout performer worth mentioning, particularly those anchored by national and global tenants.

These assets offer a particularly compelling opportunity for investors, as they tend to be underpinned by long-term leases, CPI-linked rent reviews and high underlying land values – factors that make them particularly attractive in today’s inflationary environment.

The only downside is that these assets can be hard to come by, with supply tending to remain very limited (another reason they are highly sought-after).

Office – its time is coming

It’s no secret that Australia’s office market is still in recovery mode following pandemic lockdowns.

Across the office sector, we are still seeing high incentives being offered to attract tenants, and in my view, this means the cashflows in this sector don’t quite stack up just yet.

But this won’t last forever, and the time for office to return to favour is approaching.

Eight steps to becoming a successful commercial property investor

Commercial property is becoming an investment of choice for a broader cross-section of investors but there are some steps to take to ensure the best prospects of success.

The office market is offering attractive yields relative to other asset classes, though there are significant variations across geographic markets.

Perth, for instance, has the highest levels of return-to-work occupancy nationally, and for the first time in a long time, is outperforming its east coast counterparts.

By way of background, the Perth CBD office market has seen net absorption of more than 90,000 square metres of office space over the past 24 months, according to Knight Frank Australia.

This has pushed down vacancy rates, and softened incentives as both new and existing tenants have returned to the market, buoyed by a strong resources sector.

We can expect to see upwards pressure on Perth CBD rents and a reduction in incentives in 2024.

Other trends worth noting include a continued flight to quality as businesses seek high-quality spaces that will not only attract staff back into the office, but also encourage productivity.

Opportunities also exist in fringe markets. In West Perth, vacancy rates for quality office space are tight, and in the absence of new supply or new commitments planned for the precinct, are likely to tighten further. This is giving investors a more imminent opportunity to capture rising demand for prime/A-grade stock.

The overarching theme: fantastic opportunities in 2024

Over the past year, rising interest rates have no doubt presented a key challenge across the commercial property market.

In 2024, we’re going to see this shape opportunities in a different way. With interest rates nearing their peak, our team is already starting to see opportunities to lock away fantastic assets at great prices.

Those who wait for interest rates to have turned a corner will likely miss the bottom of the market, and the valuable opportunities that come with it.